sacramento county tax rate

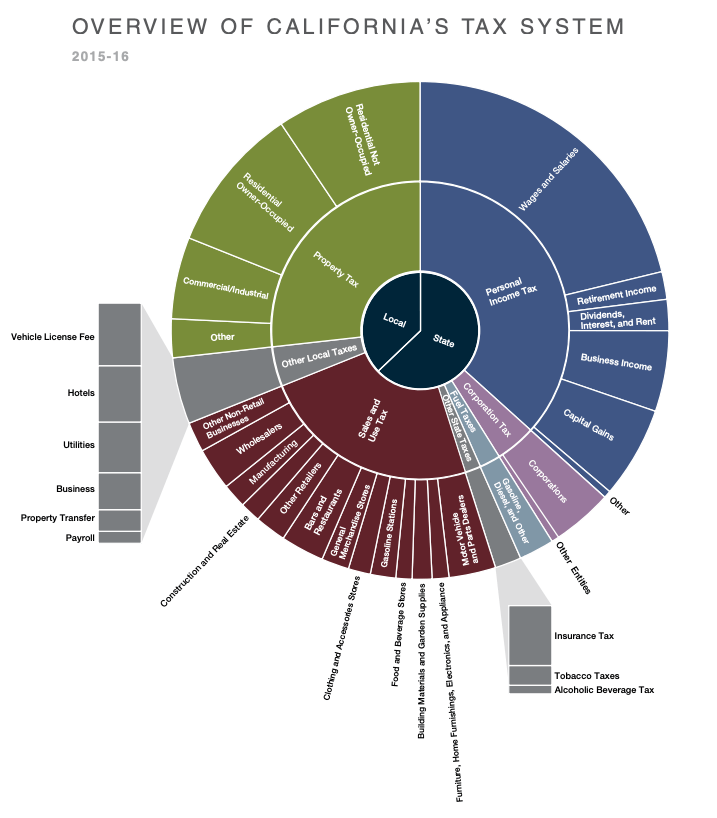

The California state sales tax rate is currently. Department of finance auditor-controller division 2022-2023 equalized assessed values by tax rate areas rpt clmn 5 6 8 10 11 5 6 8 10 11.

About Proposition 19 2020 Ccsf Office Of Assessor Recorder

Sacramento County has property tax rates that are similar to most counties in California.

. Sacramento is in the following zip codes. Tax Rate Areas Sacramento County 2022 A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the. Sacramento county tax rate area reference by primary tax rate area primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04.

Carlos Valencia Assistant Tax Collector. Secured - Unitary Tax Rolls Collections. While Sacramento County collects a median of 068 of a propertys each year as property tax the actual amount of property tax collected is lower compared to the rest of California.

Tax Collection Specialists are available for customer assistance via telephone at 916 874-6622 Monday Friday from 900am to 400pm or via email at TaxSecuredsaccountygov. SACRAMENTO COUNTY 2021-2022 COMPILATION OF TAX RATES BY CODE AREA CODE AREA 03-135 CODE AREA 03-136 CODE AREA 03-137. Sacramento County Sci Rates 2022.

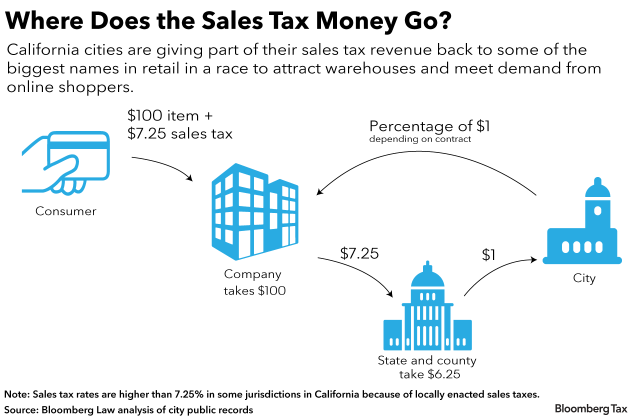

This is the total of state county and city sales tax rates. The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and 15 Special tax. The current total local sales tax rate in Sacramento CA is 8750.

Tax Accounting General Information There are various ways to ask Auditor-Controller Tax Accounting questions regarding Property Taxes. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. The minimum combined 2022 sales tax rate for Sacramento California is.

County of Sacramento Tax Collection and Business Licensing Division. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. The fee is charged at a rate of one dollar 100 for every vehicle registered to an owner with an.

This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. 94203 94204 94205. View the E-Prop-Tax page for more information.

This is mostly due to the general tax levy of 1. The Sacramento County Sales Tax is 025 A county-wide sales tax rate of 025 is applicable to localities in Sacramento County in addition to the 6 California sales tax. The December 2020 total local sales tax rate was also 7750.

For a list of your current and historical rates go to the. View the E-Prop-Tax page for more information. This is the total of state and county sales tax rates.

Sales Tax Breakdown Sacramento Details Sacramento CA is in Sacramento County. The minimum combined 2022 sales tax rate for Sacramento County California is. Some property owners in San Diego City have a.

The current total local sales tax rate in Sacramento County CA is 7750. Sacramento County collects on average 068 of a propertys. 1788 rows California City County Sales Use Tax Rates effective October 1 2022 These rates may be outdated.

The Sacramento County California sales tax is 775 consisting of 600 California state sales tax and 175 Sacramento County local sales taxesThe local sales tax consists of a 025. This is the total of state and county sales tax rates. The December 2020 total local sales tax rate was also 8750.

The California sales tax rate is currently. 700 H St 1710 Sacramento CA 95814 916 874-6622.

Food And Sales Tax 2020 In California Heather

Apple S 22 Year Tax Break Part Of Billions In California Bounty 1

Coffee And Community Improvement Districts Unpacking The Mystery Of The 7 Starbucks Macchiato Salon Com

Transfer Tax Calculator 2022 For All 50 States

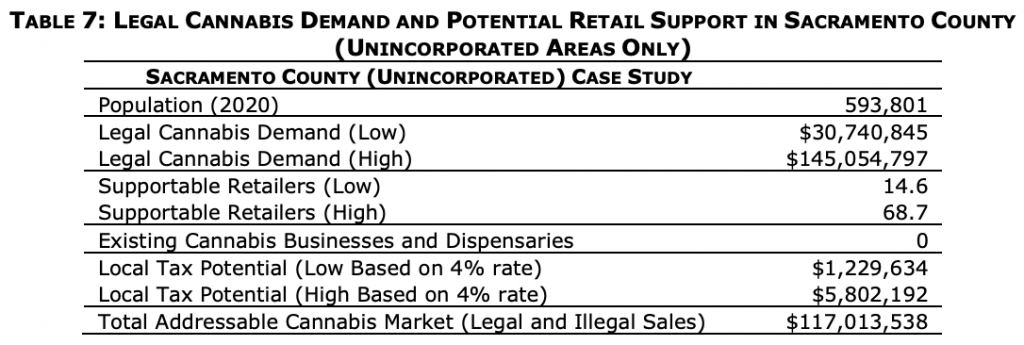

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

State Unveils New Sales Tax Tool To Reduce Retailer Errors And Consumer Complaints Davis Ca Patch

Sacramento County Transfer Tax Who Pays What

How Healthy Is Sacramento County California Us News Healthiest Communities

Orange County Ca Property Tax Search And Records Propertyshark

California Sales Tax Rates Vary By City And County Econtax Blog

California S Corporate Income Tax Rate Could Rival The Federal Rate Tax Foundation

California Sales Tax Guide For Businesses

Politifact Mostly True California S Taxes Are Among The Highest In The Nation

Sacramento Real Estate Blog By Erin Stumpf Sacramento County Supplemental Tax Bills Triggered By Reassessment Events And They Must Be Paid

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

Taxation In California Wikipedia

Local Marijuana Bans In California Keep Illicit Market Alive And Block Revenue Study Shows Marijuana Moment